How much do you know about the Earned Income Credit from the IRS?

The Earned Income Credit is a refundable tax credit for workers with lower incomes. If you qualify for it, the IRS will pay you money even if you don’t owe any taxes.

If you have a child, you may qualify for the Earned Income Credit and the Child Tax Credit. Very low-income residents without children may also qualify for the Earned Income Credit.

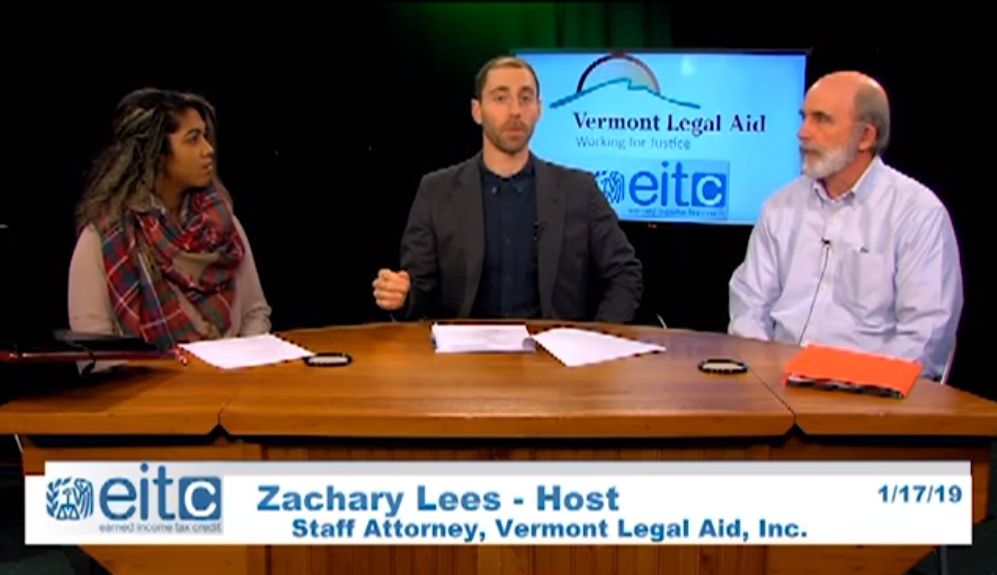

Watch a video or read more on the Earned Income Credit.