Wondering about bankruptcy and your situation?

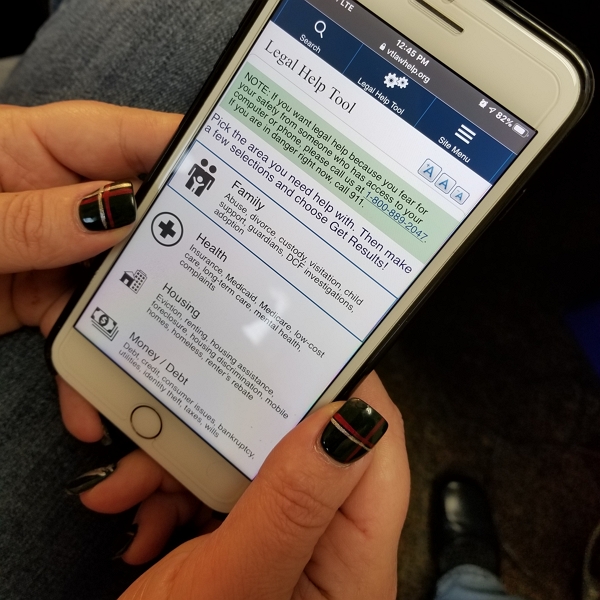

Use the Legal Help Tool to find out how bankruptcy might, or might not, help with situations such as:

- credit card debt

- medical debt

- personal loan debt

- student loan debt

- utilities debt

- back rent debt

- child support debt

- alimony debt

- car payment debt, or

- repossession.

Try the bankruptcy section of the Legal Help Tool! You can select the area you need help with. Then tap the Get Results! button.

If you are dealing with overwhelming debt, you may be thinking about bankruptcy. Here's the first thing to consider: “Is bankruptcy right for me?” For many Vermonters, it may not be the best choice or the timing may not be right.

To figure out if bankruptcy is right for you, follow these steps:

-

Check if you have “exempt” property and income.

Before you think about bankruptcy, you should know that “exemption laws” can let you keep your exempt income and property – with or without a bankruptcy. By law, exempt income and property cannot be taken to pay for a debt.

Learn about exempt income and property and how to protect it from debt collection. You may not want to file for bankruptcy after all if all your income and property is exempt.

-

Find out what bankruptcy can and cannot do for you.

Read common questions and answers about bankruptcy. Read our FAQ about bankruptcy in Vermont. It describes the different kinds of bankruptcy and how they may help you, or not.

-

Be prepared to pay a fee to file for bankruptcy.

To file for bankruptcy, you need to pay the court filing fee. The fee to file a Chapter 7 bankruptcy is $338. If your income is very low (below 150% of the federal poverty guidelines) and you do not own any property, you can ask the court to waive the filing fee. It is up to the court to decide if you qualify for a fee waiver.

You can also ask the court to let you pay the fee in installments. This is usually done in four payments over four months. If you pay in installments, you must make all the payments before your bankruptcy is finalized.

-

Ask us for advice.

If you have a low income and you have questions after reading the information above, contact us. Fill out our form and we will call you back. Your information will be sent to Legal Services Vermont. You can also call us at 1-800-889-2047.

After we speak with you, we may send you a questionnaire to help us give you further advice. It asks about your income, things you own, debts, and household expenses. You will return the questionnaire to us and we can help you decide if bankruptcy is right for you. If it is the right next step, we will send a list of information that you need to gather to prepare your bankruptcy case.

-

Find a bankruptcy lawyer and pay their fee.

If you decide that bankruptcy is your best option, you will need to find a bankruptcy lawyer to work with. Each lawyer sets their own fees. The fees vary depending on your situation. Usually lawyers ask for payment up-front for their services.

You can do an online search for “bankruptcy attorney” in your area. You can also visit the Vermont Bar Association Lawyer Referral Service website or call them at 1-800-639-7036.

Legal Services Vermont and Vermont Legal Aid cannot represent you in a bankruptcy. But if you have a low income, contact us for advice, to see if bankruptcy is right for you, and possibly get information about reduced-fee bankruptcy lawyers.

-

Take a credit counseling course.

Once you have gathered your information, found a lawyer, and have the filing fee, call us again. We can tell you if you qualify for a free credit counseling course. The law says you must take a credit counseling course before you can file for bankruptcy. The Credit Counseling Course can be completed online or over the phone.

-

File for bankruptcy.

When you’ve taken the steps above, you will be able to file for bankruptcy. Your bankruptcy petition will be filed with the federal Bankruptcy Court. You will pay the filing fee.

An impartial “trustee” will be assigned to your case. You will have what is called a 341 Meeting (also known as Meeting of the Creditors). This is generally a meeting with you, your attorney and the bankruptcy trustee. Creditors (the companies or people you owe money to) do have the option to appear at this meeting, but it is rare for them to appear in simple Chapter 7 bankruptcy cases. The trustee will take any non-exempt property, income and/or assets and pay your creditors. Most people with low income who file Chapter 7 do not own any property or income that is non-exempt.

Before your bankruptcy is complete, you will have to take a second course called Debtor Education. Similar to Credit Counseling, this course can be done online or over the phone. After some time, the court may decide to finalize the bankruptcy. This process can take a few months from the time you file your petition. The bankruptcy will stay on your credit report for 10 years.

Watch our bankruptcy videos

Watch our bankruptcy videos

Created by attorneys and paralegals at Legal Services Vermont, this three-part video series covers the Chapter 7 bankruptcy process. The videos are each 12 to 15 minutes long.

- Video 1: Steps to prepare for filing bankruptcy

- Video 2: The process of filing a Chapter 7 bankruptcy

- Video 3: What happens after a bankruptcy case

Legal Services Vermont would like to thank the American College of Bankruptcy Foundation for their support of this project.

Learn more about bankruptcy

Follow these links to learn more about bankruptcy:

- Exempt income and property and how to protect it from debt collection

- Frequently asked questions (FAQ) about bankruptcy in Vermont

- United States Bankruptcy Court, District of Vermont

- Bankruptcy Basics: Bankruptcy Basics is a publication of the U.S. Courts that provides basic information about bankruptcy, explains the different chapters, and answers common questions about the bankruptcy process. It also contains helpful videos.

- Information about filing for bankruptcy without an attorney from the United States Federal Courts

- Vermont’s Pro Se Packet from the United States Bankruptcy Court, District of Vermont

- General Consumer Information from the United States Department of Justice

- Credit Counseling and Debtor Education Information from the United States Department of Justice

- Means Testing Information from the United States Department of Justice